Data centers — and potential increases in energy costs — are coming to Chesterfield.

💡 TL;DR

Chesterfield is set to host several large data centers, bringing jobs and tax revenue but also huge new energy demands.

Dominion projects that electricity rates will likely rise, though how much residents will pay is still uncertain.

A while back, we saw some things on social media about the increase in data centers being built across the country, especially in rural and less-developed areas. Several have already been built in Texas, Meta is building a huge one in Louisiana, and there are others going up in different parts of the country. These projects are mostly driven by the increased use and investment in AI, which we’re seeing everywhere.

Much of this development is exciting—it could bring down the cost of using AI, make it available to more people, and increase AI’s capabilities. However, many residents who live close to existing data centers have been significantly affected by their construction: light, air, noise, and water pollution; decreased water availability; and increased electricity rates and disruptions in service.

I’ve been concerned about this, so I decided to use AI to research one aspect that will affect us all: energy costs. One documentary we watched showed how residents in New Jersey and Texas saw massive increases in their electricity bills due to nearby data centers. The rate hikes were driven by both the centers’ huge power usage and the cost of subsidizing new infrastructure to support them. Understandably, no one was prepared for those increases. Since our electricity bills are already a significant part of the monthly budget (especially in summer), the last thing I want is to get stuck with another large payment.

I’m also concerned about the environmental effects I mentioned earlier, but since energy usage alone is a lot to think about, I’ll save that research for later if anyone’s interested.

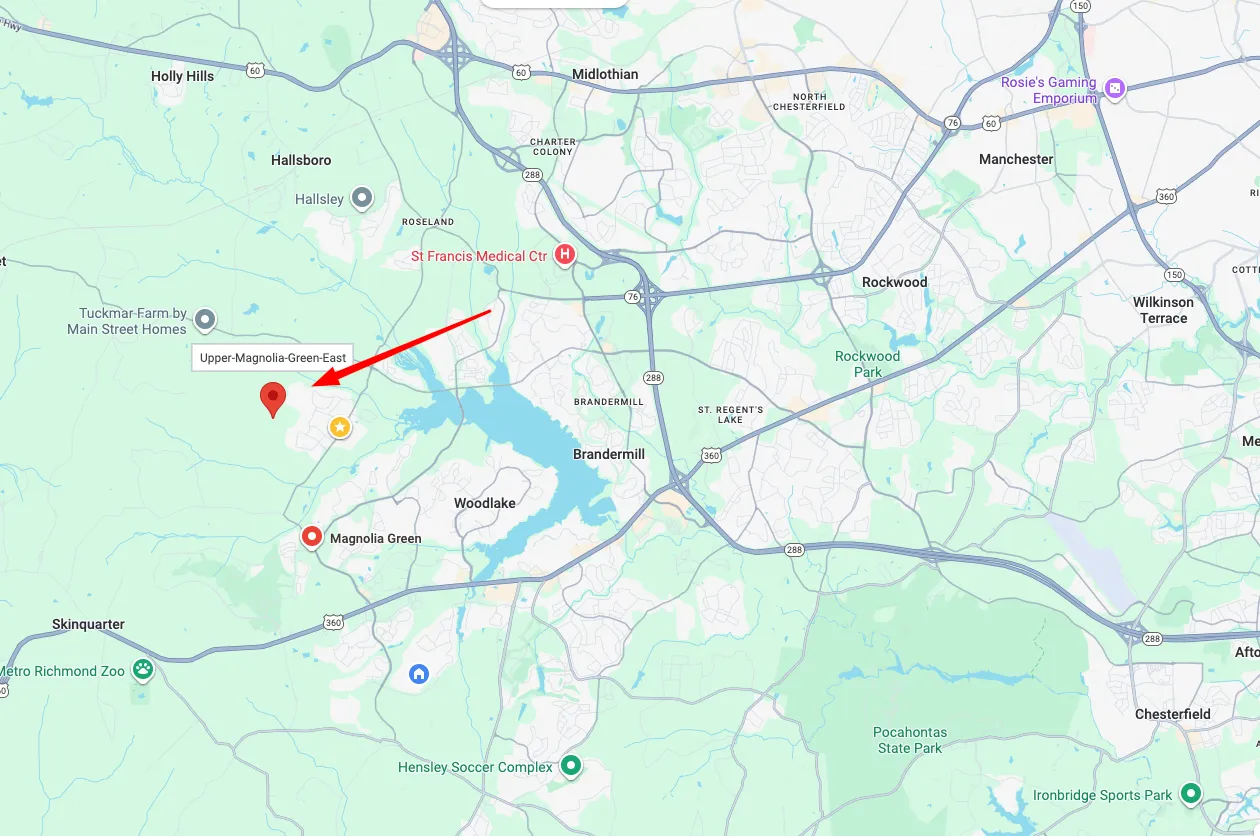

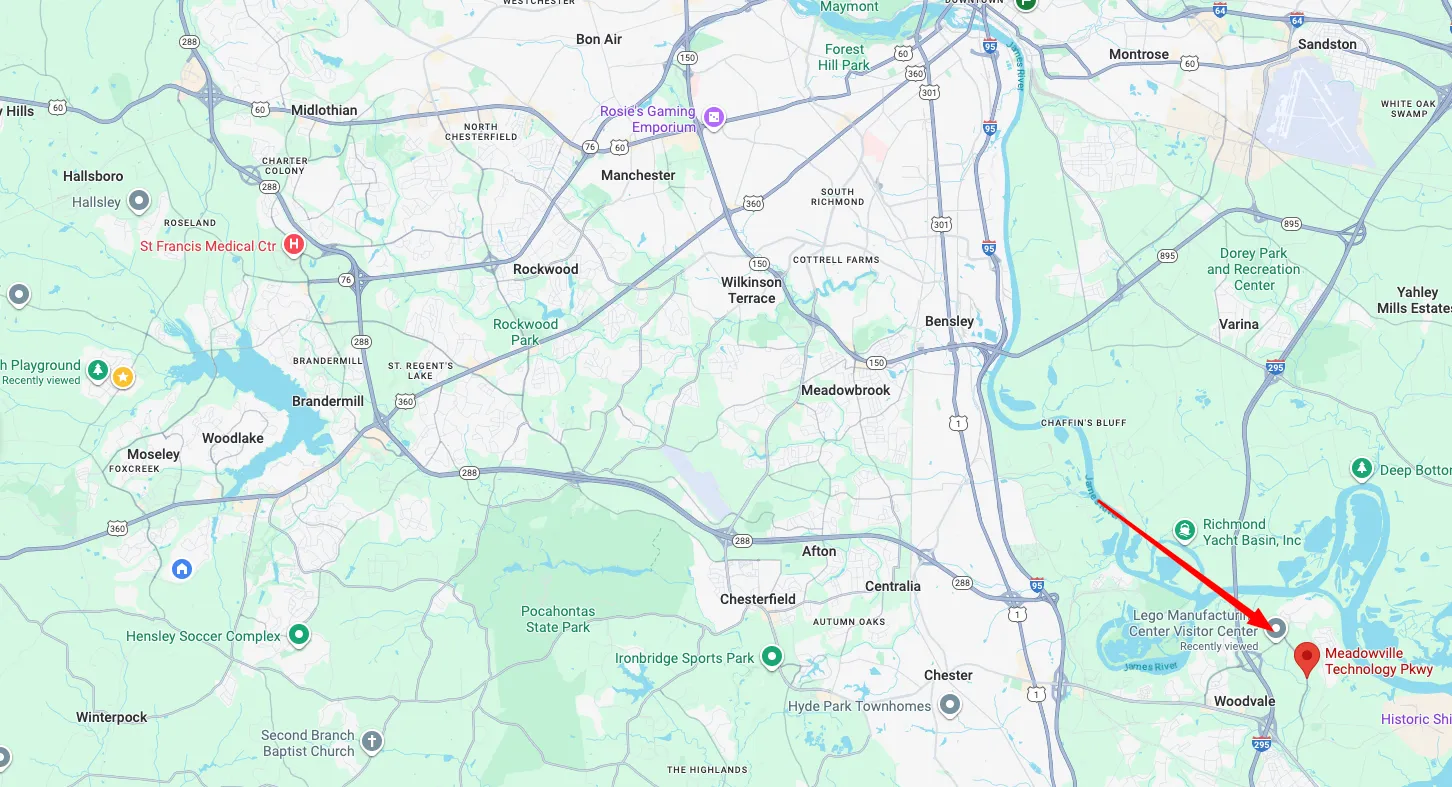

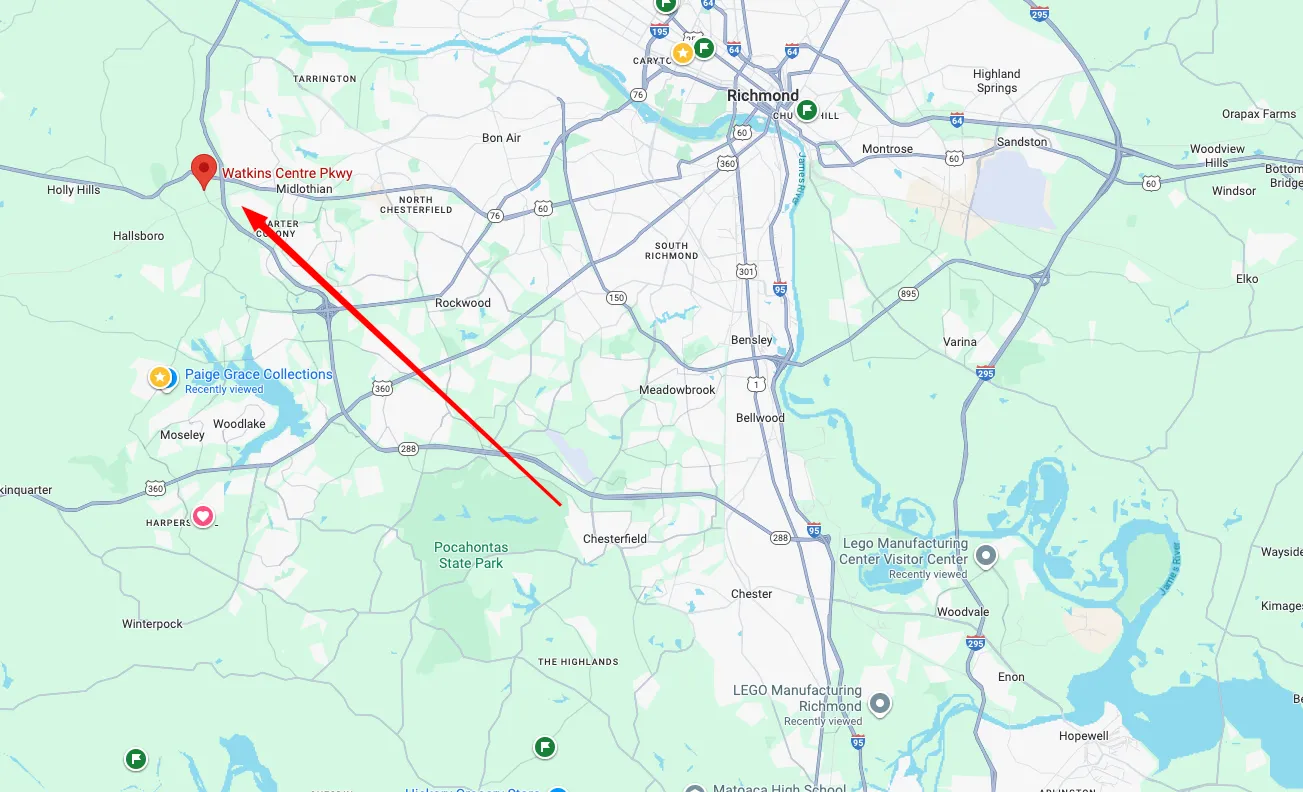

I’ve attached a document from Grok (X/Elon Musk’s AI) that outlines the data centers planned for our area, along with maps showing their locations. The nearest to Harpers Mill is the Upper Magnolia Green Data Center Campus, a 740-acre hyperscale facility just north of Magnolia Green. Three others are being built in the Meadowville Technology Park, near the Lego production facility, Amazon warehouses, and Dominion Energy’s plant on the James River. Another is slated for Watkins Center South, just south of Target off Otterdale Road near the 288/Midlothian Turnpike interchange. There’s also one in Powhatan, about 20 miles west.

I’ve also attached Grok’s assessment of our electricity rates. In short, it says we can expect rates to rise, though it’s unclear by how much. Some increases could be steep if the grid updates needed for these data centers outpace Dominion’s revenue. It’s definitely something to watch as these projects move forward.

Upper Magnolia Green Data Center Campus

This campus is just north of Magnolia Green, near the intersection of Otterdale and Genito Roads. It’s a massive 740-acre site that’s been rezoned for hyperscale data centers, with building heights up to 150 feet.

Data Centers in Meadowville Technology Park

This site is near the Lego production facility and Amazon warehouses, just off Jefferson Davis Highway (Route 1) near the James River.

Data Center at Watkins Center South

This site is near Westchester Commons, just south of Target off Otterdale Road near the 288/Midlothian Turnpike interchange.

Grok: Who is building data centers in Chesterfield County, VA?

Data Center Projects in Chesterfield County, Virginia

Chesterfield County, located near Richmond, has seen significant data center development in 2024-2025, driven by demand for AI and cloud infrastructure. The Chesterfield Economic Development Authority (EDA) has actively rezoned land for these projects, often partnering with utilities like Dominion Energy for power upgrades. Below is a summary of key ongoing or recently approved projects, including the companies involved. These are primarily hyperscale facilities, with construction timelines ranging from 2025 to 2028.

| Company/Operator | Project Name/Site | Details | Status |

|---|---|---|---|

| Bermuda Hundred Road Data Center (near Meadowville Technology Park) | A 300+ acre site at 2700 Bermuda Hundred Road. Part of a $9B statewide investment through 2026, focused on AI and cloud expansion. Initial phase includes one building; expected to create jobs and tax revenue. Power needs undisclosed but tied to Dominion’s grid upgrades. | Pre-construction (site grading started June 2025); full build: 18-24 months. | |

| Chirisa Technology Parks (CTP) & PowerHouse Data Centers | Digital Drive Campus (Meadowville Technology Park) | 104-acre acquisition adjacent to CTP’s existing facility. Five AI-ready buildings totaling 600,000+ sq ft and 300 MW capacity. $240M+ investment; partners with Dominion for a new substation (part of 1 GW grid expansion). Expected to create 200+ jobs in construction/operations. | Construction started September 2024; first facility by 2026, full campus by 2028. DPR Construction as general contractor; Gensler (architect), Timmons Group (civil engineering). |

| Tract | Upper Magnolia Green Data Center Campus | 740-acre rezoning in western Chesterfield. Master-planned park for hyperscale facilities; building heights up to 150 ft. Includes accessory uses like offices and R&D. Funded partly by $750M JV for CoreWeave tenancy. | Rezoning filed February 2025; site acquisition July 2025; construction pending operator commitments. |

| Skyward Holdings & Aeris Investments (likely developers for unnamed operator) | Watkins Centre South | 350-acre site near Westchester Commons (750 Watkins Centre Parkway). Zoned for data centers, offices, warehouses, and substations. Part of EDA’s broader rezoning; exact operator undisclosed but motivated by talks with a “top-tier” firm. | Zoning approved May 2025; site acquired for $60M (combined with Upper Magnolia); construction timeline TBD. |

| CTP & PowerHouse Data Centers (additional) | CTP-02 and CTP-03 | Expansions at Meadowville Technology Park for CoreWeave. 242,000 sq ft existing facility to be upgraded; new builds for hyperscale/AI. | Under development; tied to Digital Drive funding. Delivery by 2026. |

Nearby Areas (e.g., Powhatan County, ~20 miles west)

While the focus is Chesterfield, one major project borders the area:

- Province Group: 1318 Page Road Data Center Campus (Powhatan). 1.525M sq ft across three buildings; $2.7B-$3B investment. 150-200 direct jobs; 165 projected by 2034. | Approved October 2024; buildout 5+ years.

These projects highlight Chesterfield’s emergence as a secondary data center hub after Northern Virginia’s “Data Center Alley.” Concerns include energy demands (potentially doubling Virginia’s needs by 2040) and environmental impacts, with Dominion proposing new transmission lines and a natural gas plant in the county. For more details, check the Chesterfield EDA or Dominion Energy filings.

Grok: How likely is it that these buildings will increase the power bills for residents of this area? Or is it still TBD and hard to determine?

Likelihood of Increased Power Bills for Chesterfield County Residents Due to Data Center Development

The development of data centers in Chesterfield County, Virginia, particularly hyperscale facilities by companies like Google, Chirisa Technology Parks (CTP), PowerHouse Data Centers, and others, raises concerns about potential impacts on residential power bills. Below, I assess the likelihood of increased costs, the factors at play, and why it may still be too early to determine definitively.

Key Factors Influencing Residential Power Bills

-

Massive Energy Demand:

- Data centers, especially those supporting AI and cloud computing, are power-intensive. For example, the Digital Drive Campus (CTP/PowerHouse) targets 300 MW, and Google’s Bermuda Hundred site could require similar or greater capacity. Chesterfield’s projects collectively may demand 1–2 GW, with Virginia’s total data center load projected to double to 8–10 GW by 2040.

- Dominion Energy, the primary utility, must supply this power, potentially straining the grid. Hyperscale data centers can consume as much electricity as small cities, increasing overall demand.

-

Infrastructure Costs:

- Dominion is investing heavily in grid upgrades, including new substations (e.g., for Digital Drive) and transmission lines. A proposed 500 kV line and a natural gas plant in Chesterfield (to replace coal units at Chesterfield Power Station) aim to meet data center needs.

- These upgrades cost billions (e.g., $1B+ for transmission lines). Utilities often pass infrastructure costs to ratepayers through rate hikes, though the allocation between residential and commercial users varies.

-

Rate Structure and Cost Allocation:

- Virginia’s regulated utility market allows Dominion to propose rate increases, subject to State Corporation Commission (SCC) approval. Data centers, as large commercial customers, negotiate direct contracts with utilities, sometimes covering a portion of infrastructure costs. However, if data center demand accelerates grid investments, residential customers may face higher base rates or surcharges.

- For example, Dominion’s 2024 rate filings cited data center growth as a driver for a 3–5% annual increase in residential bills through 2030, though specific impacts from Chesterfield projects are not isolated.

-

Renewable Energy and Efficiency:

- Some projects (e.g., Google, CTP) incorporate renewables like solar and battery storage, potentially offsetting grid strain. However, renewables alone can’t meet baseload needs, and reliance on gas or coal plants may increase costs if fuel prices rise.

- Energy efficiency measures in newer data centers (e.g., liquid cooling for AI chips) could reduce per-unit power demand, but the sheer scale of projects may still drive total consumption.

-

Local Economic Benefits vs. Costs:

- Data centers generate tax revenue (e.g., Google’s $9B investment could yield millions annually for Chesterfield). Local governments may use this to offset utility cost impacts or fund community benefits. However, if tax incentives are overly generous, residents may bear a disproportionate share of infrastructure costs.

Likelihood Assessment

-

Moderate to High Likelihood of Some Increase:

- Given the scale of Chesterfield’s data center projects and Dominion’s planned grid investments, it’s likely that residential power bills will see some increase over the next 5–10 years. Historical data from Northern Virginia, where data centers dominate, shows residential rate hikes of 10–15% over a decade (2015–2025), partly due to similar infrastructure demands.

- Dominion’s 2025 Integrated Resource Plan (IRP) projects a 40% rise in electricity demand by 2040, driven largely by data centers. This could translate to 2–4% annual bill increases for residents, depending on SCC approvals and cost-sharing with data center operators.

-

Uncertainties (TBD Factors):

- Cost Allocation: It’s unclear how much data center operators will directly fund infrastructure (e.g., via private substations or power purchase agreements). If companies like Google or CTP cover significant costs, residential impacts could be mitigated.

- Regulatory Decisions: The SCC’s rulings on Dominion’s rate requests will determine how costs are distributed. Public hearings (ongoing in 2025) may push for protections for residential ratepayers.

- Energy Mix: The balance of gas, renewables, and potential small modular nuclear reactors (SMRs) will affect costs. Gas price volatility or delays in renewable deployment could exacerbate bill increases.

- Project Scale: Not all proposed projects (e.g., Tract’s Upper Magnolia Green) have firm operators or timelines. If fewer projects materialize, demand growth may be slower, reducing pressure on rates.

-

Local Context:

- Chesterfield residents already face rising bills due to broader grid modernization (e.g., Dominion’s coal-to-gas transition). Data centers add incremental pressure, but isolating their impact is challenging. For perspective, a typical Dominion residential bill ($120–150/month for 1,000 kWh) could rise $5–15/month by 2030, with data centers contributing a fraction of that.

Why It’s Still Hard to Determine

- Early Stage of Projects: Most Chesterfield data centers (e.g., Google, Digital Drive) are in pre-construction or early development (2025–2026). Power contracts and infrastructure plans are not fully public, making precise cost projections difficult.

- Regulatory Lag: SCC reviews can take 12–18 months, and Dominion’s next major rate case (expected 2026) will clarify cost allocations. Until then, estimates rely on trends from Northern Virginia.

- External Factors: Global energy prices, federal incentives for renewables, and Virginia’s clean energy mandates (e.g., 100% carbon-free by 2045) will shape costs but are unpredictable.

Conclusion

While it’s moderately to highly likely that Chesterfield County residents will see some increase in power bills due to data center development, the extent is still TBD. Increases may be modest (e.g., $5–10/month by 2030) if operators and Dominion share costs effectively and renewables scale up. However, without strong regulatory protections or direct funding from data center companies, residents could face steeper hikes, especially if grid upgrades outpace revenue from taxes or contracts. Monitoring SCC filings and Dominion’s IRP updates will provide clearer answers as projects progress.

For real-time updates, you can check Dominion Energy’s website or Chesterfield EDA announcements. If you’d like me to search X or the web for recent posts or articles on this topic, let me know!